Conventional mortgages with flexible terms of 15-30 years offer real estate buyers adaptability in repayment schedules, aligning with financial capabilities. This empowers homeowners to manage life changes and enhances confidence in homeownership, though buyers should balance short-term relief with long-term cost considerations and consistent repayment history for solid financial foundation building.

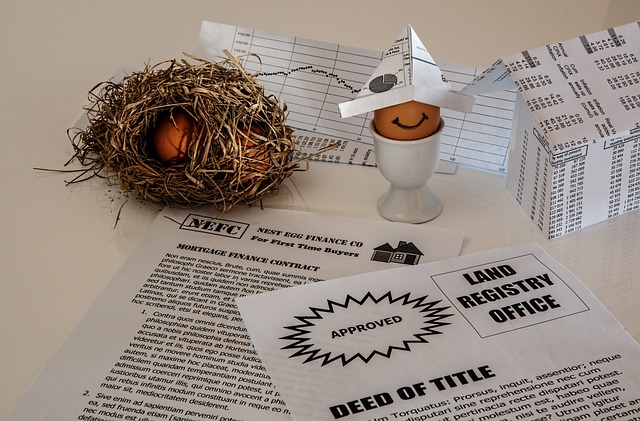

In the dynamic world of real estate, understanding financing options is key. This article delves into conventional mortgages with flexible terms—a game-changer for buyers seeking tailored financial solutions. We unravel the basics of conventional mortgages and explore diverse term lengths, highlighting benefits and considerations. Whether you’re a first-time buyer or experienced investor, this guide equips you with insights to navigate the real estate market confidently, ensuring your mortgage aligns with your unique needs and aspirations.

Understanding Conventional Mortgages: Basics Unveiled

In the real estate world, conventional mortgages are a cornerstone of homeownership, offering a path to achieving one’s dream of owning property. These mortgages are not insured or guaranteed by any government agency, unlike Federal Housing Administration (FHA) or Veterans Affairs (VA) loans. Instead, they are backed by private financial institutions, making them a popular choice for those with strong credit scores and stable income.

The beauty of conventional mortgages lies in their flexibility. Lenders offer various terms, typically ranging from 15 to 30 years, allowing borrowers to select a repayment schedule that aligns with their financial capabilities. This adaptability is a significant advantage, as it enables homeowners to manage their monthly payments effectively while navigating life’s twists and turns.

Flexibility in Term Lengths: Options Explored

In the realm of real estate, flexibility is a highly sought-after feature, and conventional mortgages with adjustable terms cater to this desire. Borrowers now have more control over their loan repayment journey with options that suit various financial scenarios. Traditionally, fixed-term mortgages were the norm, but evolving market dynamics have given rise to flexible alternatives. Lenders offer terms ranging from 5 to 30 years, allowing homeowners to choose a length that aligns with their income stability and long-term goals.

This flexibility is particularly beneficial for those anticipating life changes, such as career shifts or family expansions. Short-term loans provide freedom to adjust finances accordingly, while longer terms offer peace of mind during uncertain times. Real estate professionals recognize this advantage and often guide clients in selecting terms that balance risk and stability, ensuring a solid financial foundation for their future homes.

Benefits and Considerations for Real Estate Buyers

For real estate buyers, conventional mortgages with flexible terms offer a unique advantage in today’s dynamic market. One of the key benefits is adaptability; borrowers can adjust their monthly payments based on their financial flow, making it easier to manage unexpected expenses or changing life circumstances. This flexibility allows folks to navigate the often labyrinthine journey of homeownership with more confidence.

Considerations for buyers include understanding the potential long-term costs and ensuring they qualify for such mortgages. It’s important to remember that while flexible terms provide relief in the short term, maintaining a consistent repayment history is crucial for building a solid financial foundation. In the world of real estate, making informed decisions now can lead to substantial savings and stability down the line.