Fixed-rate mortgages provide stability in the real estate market by offering consistent monthly payments, protecting borrowers from economic fluctuations, and facilitating long-term planning. While beneficial for predictability and cash flow, they may not be optimal in volatile interest rate environments and often come with higher upfront costs. Borrowers should weigh these factors against adjustable-rate mortgages when deciding.

In today’s volatile financial landscape, understanding fixed-rate mortgages is crucial for real estate investors. This article explores the intricacies of fixed-rate stability over loan terms, a key consideration in the competitive real estate market. We delve into the advantages of choosing a fixed-rate mortgage, such as predictability and protection from rising interest rates. Conversely, we also discuss potential disadvantages and important considerations to ensure informed decision-making for long-term financial stability in real estate investments.

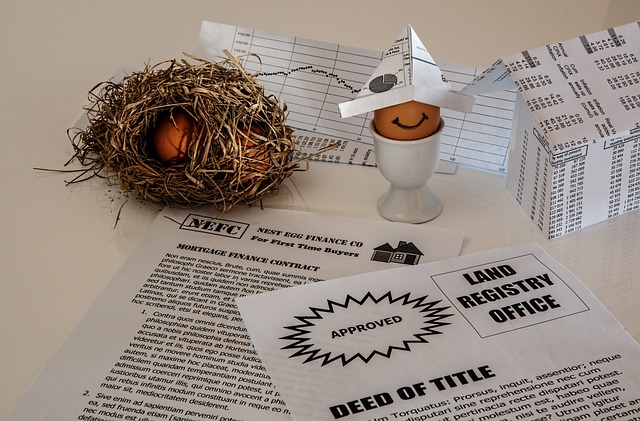

Understanding Fixed-Rate Mortgages in Real Estate

In the dynamic landscape of real estate, understanding fixed-rate mortgages is paramount for both buyers and sellers. A fixed-rate mortgage offers stability in a market that can be as fluid as the seasons. This type of loan agreement ensures consistent monthly payments throughout the entire term, providing borrowers with predictability and peace of mind. Unlike adjustable-rate mortgages, where interest rates can fluctuate over time, fixed-rate mortgages keep costs steady, making budgeting easier for homeowners.

This stability is achieved by locking in an interest rate at the beginning of the loan term. This rate remains unchanged, regardless of any changes in the broader economic climate or market forces. For real estate investors and families alike, this predictability can be a significant advantage, allowing them to plan for the long term without worrying about sudden increases in monthly payments.

Advantages of Choosing a Fixed-Rate Over the Loan Term

Choosing a fixed-rate loan for your real estate venture offers several advantages that can make it a smart financial decision. One of the key benefits is predictability and stability. With a fixed-rate, you’re securing a constant monthly payment throughout the entire loan term, eliminating unexpected increases due to market fluctuations. This provides peace of mind, allowing you to accurately plan your budget without worrying about rising interest rates.

Additionally, a fixed-rate loan offers long-term savings. While initial payments might be slightly higher compared to adjustable-rate loans, over time, the consistent rate saves you from potential spikes in future payments. This stability is especially beneficial for real estate investors aiming for long-term property appreciation, as it ensures their cash flow remains steady and predictable.

Disadvantages and Considerations for Fixed-Rate Stability

While fixed-rate stability offers peace of mind and predictability for borrowers, there are certain disadvantages and considerations to keep in mind when navigating real estate loans. One potential downside is that fixed rates may not always be favorable in a rapidly changing interest rate environment. If market rates drop significantly after you secure your loan, you might find yourself paying more than necessary over the long term. This can be particularly true for longer-term mortgages, as borrowers are locked into a higher rate for an extended period.

Additionally, fixed-rate loans typically have larger upfront costs compared to adjustable-rate mortgages (ARMs). These costs can include loan origination fees and closing costs, which can add up, especially for expensive real estate purchases. Borrowers must weigh these initial expenses against the stability of a fixed rate and the potential savings from lower future rates.